The Latest

For more than a quarter century, Policies issued by IAC™ Insurers and Programs developed by our Principals have been rated in the highest rating categories by the world’s leading rating agencies.Our unique patented risk transformation and capital funding infrastructure are designed to benefit central banks, sovereign wealth funds, institutional investors, governments, family offices, corporate entities, insurance companies, banks, asset managers, and project finance professionals.Introducing IAC Cube™, a new approach to insurance, risk transacting and capital funding | digital assets activities. For Sponsor Organisations, IAC™ provides an advanced modular rapid deployment platform for creating and operating state-of-the-art risk and capital funding structures. Insurance, Asset and Capital Markets Professionals may wish to consider accreditation through IAC™ Insurers.

The Latest

IAC™ Insurers provide …

unique risk transformation and capital funding solutions, digital assets, infrastructure and technologies

now available to governments, central banks, sovereign wealth funds, institutional investors, family offices, corporate entities, insurance companies, banks, asset advisors, and project finance professionals

For Sponsors and Market Professionals, IAC™ Insurers are infrastructure utilities which facilitate and manage their client’s transfer of unique and difficult to place risk exposures

providing the ultimate in credit quality, developing long term insurance capacity for financial and operational risks, transforming risk into capital markets obligations, or facilitating projects, acquisitions, leases and specialised assets.

at the core of our success,

The IGF System™ …

designed to provide the highest level of safety, security and assurance of timely payment

Technology | The IGF Act | Government Backed

Ratings | Patents | Regulations | IGI | IFG | IGA

Our Technology

The IGF System™ assumes risk through four standardised types of insurance policies, holds it without counterparty risk, supported through capital linked to specific risk exposures.

Insurance, asset management and capital market professionals as well as custodians, administrators, and traditional service providers support transactions and operational matters. The unique design of the technologies and the IAC™ Insurers platform converge to provide Sponsors and other industry professionals advanced infrastructure and tools to ply their expertise in solving today’s intractable issues.

Protected by Royal Assent

Each IAC Insurer™ is subject to a special Act of Parliament which was granted Royal Assent in 1991. The Investors Guaranty Fund, Ltd. (Policyholder Reserves) Act, 1991 creates a “bankruptcy proof” statutory Reserve structure designed to assure the Policy Issuer is capable of timely paying 100% of its Policy obligations.

It further protects the priority of policyholders over other creditors and mitigates “preference in bankruptcy” and other credit concerns. The IGF Act and the The IGF System™ are designed to provide the highest degree of safety, security and assurance of timely payment.

GOVERNMENT BACKED STATUTORY RESERVES

IAC™ Insurers are statutorily required to maintain assets, held by government approved custodian(s), sufficient to pay a total loss on all Policies issued.

Premiums and capital/surplus are statutorily reserved under the Investors Guaranty Fund, Ltd. (Policyholder Reserves) Act, 1991 (the “IGF Act”), special legislation which governs the operations of IAC™ Insurers.

Each Policy issued by an IAC Insurer™ is fully backed by eligible government obligations to provide safety, security and assurance of timely payment.

The unique capital structure of each IAC Insurer™ enables capital market investors to provide a high level of capital support to Policies issued by IAC™ Insurers and to participate in risk-linked investments supporting specific Policies or groups of Policies.

Ratings

For more than a quarter century, Policies issued by IAC™ Insurers and Programs developed by our Principals have been rated in the highest rating categories by the world’s leading rating agencies.

Patents Worldwide

For more than 30 years, our Principals have been creating, implementing and developing the world’s leading technologies in insurance securitisation, segregated portfolio legislation, collateralisation, risk transformation, capital funding, digital assets and financial guaranty.

The Principals invented “insurance securitisation”, which has been patented in the United States, Bermuda, European Union, including separately in United Kingdom, Ireland, Switzerland, as well as New Zealand and Australia. The IGF Act and The IGF System™ are designed to provide the highest degree of safety, security and assurance of timely payment.

IAC™ Rules & Regulations

… are a key component in governance of operations of this advanced insurance securitisation and capital funding system.

The IGF System™ operates within the IGF Act and other applicable Bermuda legislation, Reserve Resolutions, IAC™ Rules & Regulations of The IGF System™, Executive Directorate Directives, as well as standardised policy forms, capital instruments, internal operations documents, processes, procedures, and patented technologies.

IAC™ Insurers are pleased to present

The IAC Cube™

For Sponsor Groups and other Principals wishing to form and operate IAC™ Insurers using The IGF System™, The IAC Cube™ Platform provides a unique infrastructure utility for transacting in risk. We invite you to download the Brochure “IAC™ Cube – Celebrating 30 Years”.

Sponsoring an IAC Cube™

Sponsors, insurance, investment and capital markets professionals, governments, sovereign wealth funds and Principals may benefit from their participation in the formation and operations of IAC™ Insurers dedicated to their core focus objectives.

A “Sponsor Group” participates in the operation of each of the IAC™ Insurers it forms, assisted by accredited insurance, investment, advisory and capital markets professionals. Its Principals may participate in various transactional and operational roles. In addition, approved administrators, accountants, legal, actuaries, custodians and other traditional service providers support the Sponsor Group in achieving their risk mitigation, capital funding and asset valuation protection objectives with respect to their IAC™ Insurers.

Assuming Risk …

For an IAC Insurer™, assuming risk or creating internal capital funding for risk exposures involves the issuance of a Policy, on one of the four standard Policy forms.

Transaction Participants

The process begins with the prospective purchaser submitting to an IAC™ Insurance Intermediary, a Policy application containing their specific requirements. Various advisors, consultants, technical professionals, insurance broker, and/or investment bankers and broker-dealers may assist in the development of the purchaser’s Policy terms. Once complete and an IAC Insurer™ is identified to issue the Policy, a Policy Submission or Purchase Offer is submitted and a Policy is issued for premium paid.

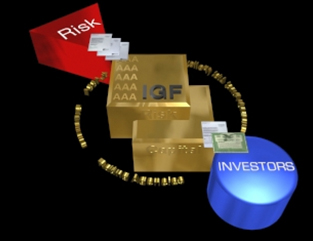

Risk Funding…

On each IAC Insurer™ (insurance securitisation platform), Insurance Syndicate managers and asset allocation advisors may participate with Risk Underwriting Advisors to match risk assumed from issuance of Policies to capital raised through the issuance of Risk Linked Obligation™s and through funds generated from the issuance of FlexGIA™

The IGF System™ provides infrastructure to create investment obligations linked to specific risk exposures or pools of risk, providing an advanced form of investment risk diversification and, in some instances, a new form of inverse risk correlation.

Investment bankers and broker-dealers may participate in pairing institutional investors and funds with Risk-Linked Obligation™s indexed to specific risk exposures or risk pools.

Transaction, operations and service professionals are key participants in the functions of The IAC Cube™.

IAC™ Community Participants …

For parties wishing to provide their professional expertise and service resources, IAC™ Insurers provide a new opportunity for expanding your client base, increasing transactional activities and increasing revenue.

We would be pleased to consider your application for accreditation in one or more IAC™ Community participant roles and invite you to download “An Invitation to Participate” for more information.

The IAC Cube™ provides Sponsors a unique opportunity to license the formation of and operate perhaps the most advanced risk transformation and capital funding platform available.

Insurance Intermediaries, insurance brokers, risk underwriting advisors, actuaries, claims settlement professionals, insurance company administrators, consulting advisors, scenario analysts, capacity allocation advisors and other insurance industry professionals are key resources for each IAC Cube™ platform.

Asset oversight advisors, portfolio managers, insurance syndicate managers, strategy consultants, and capital allocation advisors provide essential ongoing operational services in managing an IAC Cube™’s capital and asset allocation activities. Investment banks, broker-dealers and securities advisors are key participants in creating capital instruments linked to specific risk exposures, other forms of capital instruments and FlexGIA™

Insurance administrators, legal firms, accountants, valuation professionals, custodians, banks, trustees, ratings agencies, consultants, advisors, regulators, and other insurance industry and capital markets related participants may have an interest in understanding the workings of IAC™ Insurers and may wish to provide their services or otherwise interact with IAC™ Insurers.

A New Approach to Digital Risk Transfer